A 2022 study of 204 new PVC flooring samples found that 16% exceeded regulatory limits for restricted plasticizers, primarily because of recycled content carrying legacy chemicals. The regulatory landscape is shifting toward complete phthalate elimination, yet compliance remains more complex than simply switching to non-phthalate alternatives.

This guide covers the specific regulatory thresholds manufacturers must meet, the certifications that actually verify plasticizer compliance, and the performance trade-offs to consider when selecting compliant plasticizers for flooring applications.

Regulatory Requirements for PVC Flooring Plasticizers

Flooring plasticizer regulations vary by region and application, with the EU imposing the strictest limits and the US taking a more targeted approach.

EU REACH Restrictions

REACH Annex XVII Entry 51 restricts four ortho-phthalates in articles sold in the EU: DEHP, DBP, BBP, and DIBP. The limit is 0.1% by weight individually or in any combination in any plasticized material.

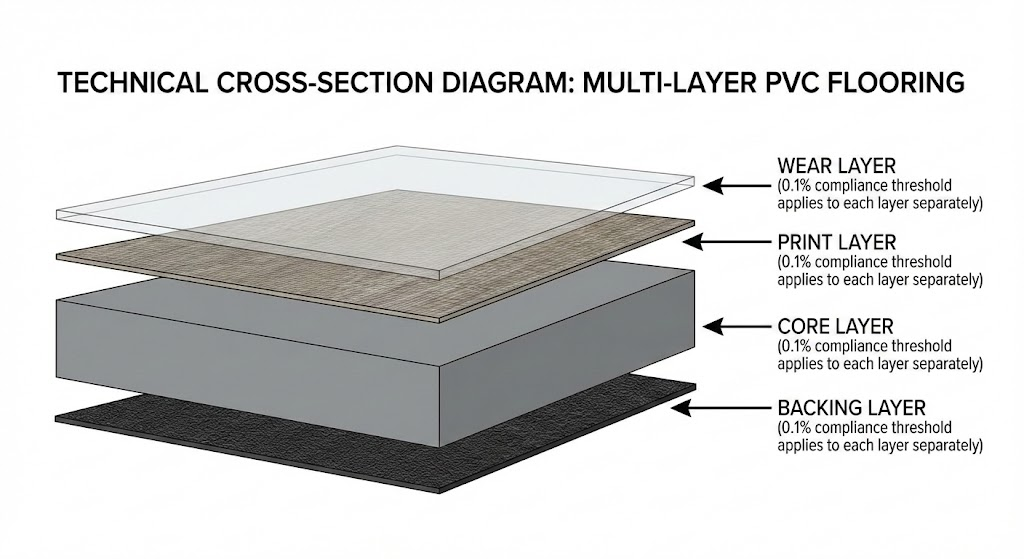

A critical detail that many manufacturers miss: this 0.1% applies to each plasticized component in a complex product, not just the total product weight. A flooring product with multiple PVC layers must meet the threshold in each layer separately.

DINP and DIDP face different treatment under REACH. They remain permitted for general use but require authorization for toys and childcare articles. For flooring, DINP is not restricted under Entry 51, though market pressure increasingly favors complete phthalate elimination regardless of regulatory status.

US Regulations

US flooring regulations are narrower than EU requirements but include several important constraints.

The Consumer Product Safety Improvement Act (CPSIA) limits DEHP, DBP, BBP, and DINP to 0.1% in children’s toys and childcare articles. Standard flooring products for commercial or residential use fall outside CPSIA scope, but products marketed for children’s spaces may trigger these requirements.

California Proposition 65 lists DEHP, DBP, BBP, DIBP, and DINP as reproductive toxicants or carcinogens. However, flooring manufacturers have some flexibility here. California’s Office of Environmental Health Hazard Assessment (OEHHA) issued a safe use determination: vinyl flooring containing 18.9% or less DINP by weight does not require Prop 65 warnings, as exposures remain below safe harbor levels.

This creates an interesting regulatory divide. DOTP offers the safest compliance path for manufacturers selling in both EU and US markets. DINP remains viable for US-only applications with proper documentation, though it requires Prop 65 labeling above the 18.9% threshold.

Floor Certification Requirements

Flooring certifications create another layer of compliance considerations, and not all certifications test for the same things.

FloorScore, developed by SCS Global Services, tests 35 volatile organic compounds per California Standard Method V1.2. Products meeting Tier 1 (lowest emissions) achieve 0.5 mg/m3 or less total VOCs. However, FloorScore does not test for phthalate plasticizers. SCS explains that plasticizers are not considered emission sources when manufactured into vinyl flooring products.

This distinction matters. A FloorScore-certified floor may still contain restricted phthalates. Manufacturers marketing non-phthalate plasticizers as a feature need additional verification beyond FloorScore.

GREENGUARD Gold certification takes a broader approach. It tests for semi-volatile organic compounds including phthalates, with a total VOC limit of 220 ug/m3. For manufacturers needing third-party verification of phthalate-free claims, GREENGUARD Gold provides stronger coverage than FloorScore.

Green building programs like LEED, BREEAM, and WELL increasingly reference phthalate content alongside VOC emissions. Major flooring manufacturers including Tarkett achieved 100% phthalate-free status in Europe and North America by 2018, driven as much by green building requirements as regulatory mandates.

Performance Requirements and Trade-offs

Compliance is only half the equation. Flooring manufacturers must balance regulatory requirements against performance and cost considerations.

Cost and Efficiency Considerations

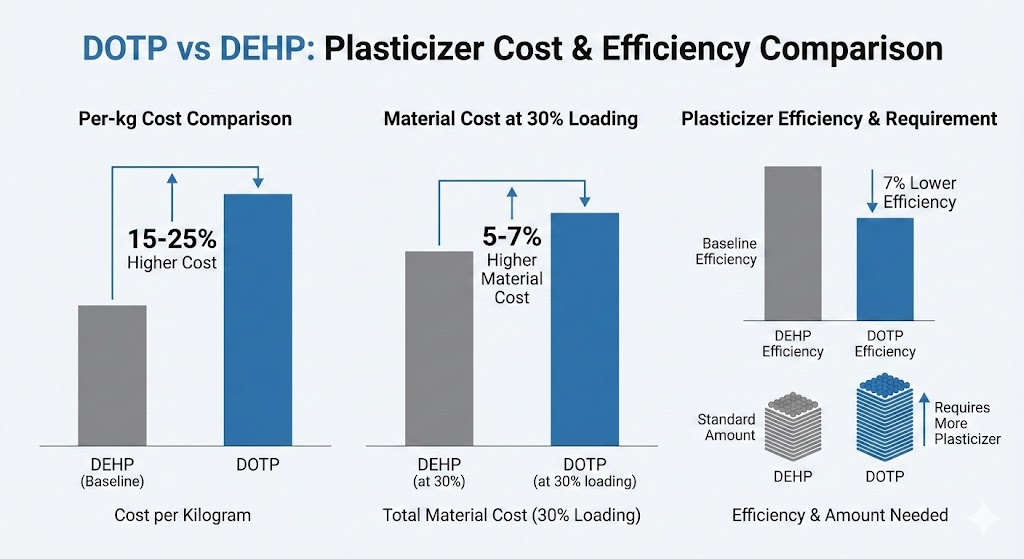

DOTP (also called DEHT) has emerged as the preferred non-phthalate alternative for flooring. It offers comparable performance to DEHP with better regulatory certainty. The trade-off is cost: DOTP typically costs 15-25% more than DEHP on a per-kilogram basis.

For a flooring product containing 30% plasticizer by weight, that premium translates to roughly 5-7% higher material costs. Processing costs can offset some of this premium. DOTP provides better thermal stability, meaning processing temperatures can remain the same or even decrease slightly compared to DEHP formulations.

Plasticizing efficiency also factors into the calculation. DOTP is approximately 7% less efficient than DEHP, requiring more plasticizer to achieve the same flexibility. Formulations designed around DEHP may need adjustment when switching to DOTP.

Processing and Migration Performance

DOTP also offers advantages in migration resistance that matter for flooring durability. Migration causes problems that typically emerge six months or more after installation: bubbles, cracks, and color fading.

Adhesive compatibility plays a significant role in migration performance. Rubber-based adhesives can accelerate plasticizer breakdown, while polyurethane adhesives with cross-linked structures provide better long-term stability. When selecting plasticizers for vinyl flooring, consider the complete system including adhesive chemistry.

DOTP shows lower migration rates than traditional phthalates in most testing conditions. Combined with better volume resistivity, it delivers improved electrical properties and reduced surface tackiness over time. These properties matter less for commodity flooring but become important for healthcare, cleanroom, and ESD-sensitive applications.

The Hidden Compliance Risk: Recycled Content

Here is where compliance gets complicated. The shift toward recycled PVC content creates a new category of compliance risk that most guidance ignores.

A peer-reviewed study published in 2022 analyzed 204 new PVC flooring samples from the Swiss market. Results showed 16% contained regulated chemicals above the 0.1 wt% threshold, with DEHP and lead being the primary culprits. The contamination source: recycled PVC carrying legacy plasticizers from products manufactured before current restrictions.

This finding challenges the assumption that new products are automatically compliant. Legacy additives in recycled content may exceed limits for decades unless actively removed during reprocessing. Standard mechanical recycling does not eliminate these compounds.

Advanced recycling technologies offer a solution. The CIRCULAR FLOORING project demonstrated dissolution recycling that achieves 99% phthalate removal. However, this technology is not yet widespread. Manufacturers using recycled PVC content must verify incoming material compliance rather than assuming it meets current standards.

The market trend across applications is toward complete phthalate elimination. Over 95% of the US vinyl flooring market has already transitioned to non-phthalate plasticizers. Major retailers including Home Depot, Lowe’s, and Menards achieved zero detectable phthalates in flooring by 2018 after committing to phase-outs in 2015.

Key Considerations

The compliance challenge for PVC flooring plasticizers is shifting. Plasticizer selection itself is largely solved with DOTP providing a clear path to compliance across all major markets. The DOTP versus DEHP decision comes down to cost tolerance and target markets.

The real complexity lies in supply chain verification. Recycled content, while environmentally valuable, introduces compliance uncertainty that requires active management. For manufacturers committed to both sustainability and compliance, incoming material testing and supplier documentation become as important as formulation decisions.